What is Overseas Direct Investment (ODI) Registration (Understanding ODI Completely)

With the advancement of globalization and the "Belt and Road" Initiative, more and more Chinese enterprises are choosing to "go global" by establishing companies overseas, acquiring enterprises, or conducting other direct investment activities through overseas investment. To achieve these cross-border investments, enterprises typically need to complete "Overseas Direct Investment Registration," abbreviated as ODI registration. So, what is ODI? Why is ODI registration necessary? What are the registration procedures and important considerations? This article will answer these questions and help you comprehensively understand Overseas Direct Investment (ODI) registration.

1. What is ODI?

ODI (Overseas Direct Investment) refers to investment activities conducted overseas by Chinese enterprises, institutions, or individuals through establishment, mergers and acquisitions, or other forms of investment. This investment can include establishing wholly-owned subsidiaries, joint ventures, acquiring overseas enterprises, or other investment activities in the form of equity or debt.

The significance of ODI lies in helping Chinese enterprises expand into international markets, optimize global layout, introduce foreign advanced technology and management experience, while enhancing the international competitiveness of Chinese enterprises. However, since overseas investment involves capital outflow from the country, which may bring significant financial and security risks, ODI activities are subject to strict supervision by the Chinese government.

2. Why is ODI Registration Necessary?

The Chinese government implements registration management for overseas investment activities, primarily to ensure the compliance of foreign exchange flows and prevent capital outflow and financial risks. Through ODI registration, the government can:

- Safeguard national financial security: Through registration and approval of overseas investments, the government can understand enterprises' capital flow situations and effectively control capital outflow risks.

- Regulate enterprises' overseas investment behavior: Ensure that enterprises' overseas investment activities are compliant and legal, avoiding "blind expansion" and "disorderly investment."

- Improve enterprises' investment success rate: ODI registration reviews enterprises' qualifications, funding sources, etc., thereby improving investment stability and helping enterprises more effectively utilize overseas markets.

For enterprises, obtaining ODI registration is also a legally compliant "passport" that not only ensures smooth overseas investment activities but also allows them to enjoy policy support in overseas business operations.

3. ODI Registration Process

The ODI registration process involves multiple departments and steps, mainly including the following stages:

- Prepare application materialsEnterprises need to prepare a series of application materials, including but not limited to:

- Copy of enterprise business license

- Overseas investment application letter

- Feasibility study report for the overseas investment project

- Articles of association of the overseas company (if establishing a subsidiary)

- Board of directors or shareholders' meeting resolution

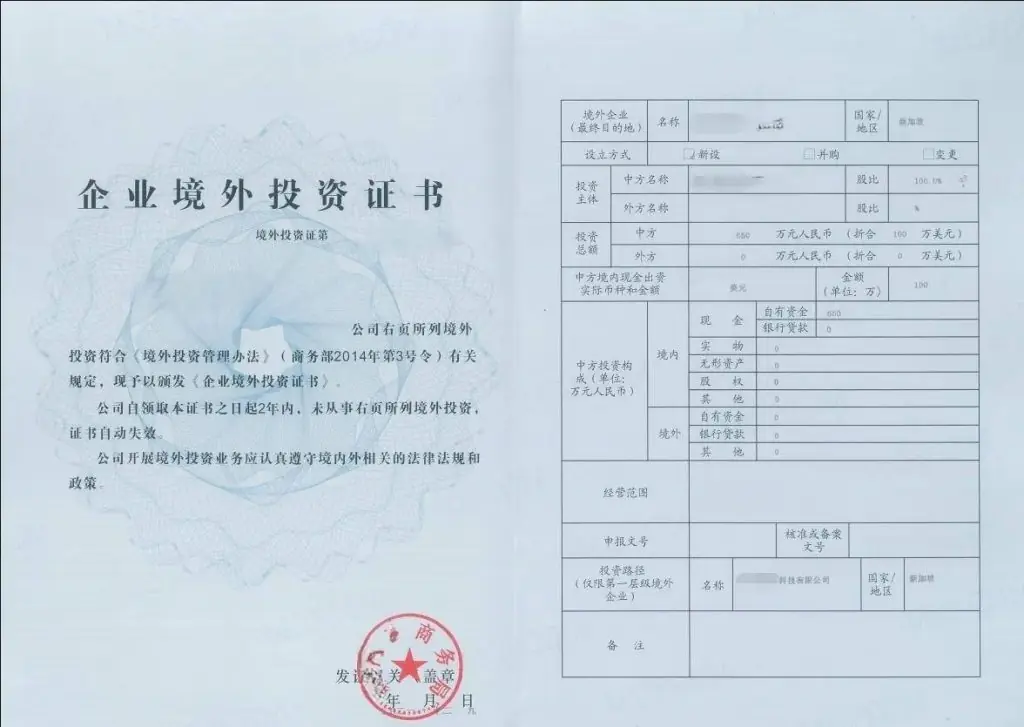

- Submit registration to the Ministry of CommerceEnterprises need to apply for ODI registration with the Ministry of Commerce or provincial commerce authorities. According to the "Measures for the Administration of Overseas Investment," projects with overseas investment amounts exceeding certain thresholds require review by the Ministry of Commerce, while small-scale investment projects can be registered at provincial authorities. The Ministry of Commerce or relevant authorities will review the materials submitted by enterprises to ensure compliance with national policies and laws and regulations.

- National Development and Reform Commission registrationSome major investment projects also require registration or approval from the National Development and Reform Commission (NDRC). Typically, projects involving sensitive industries such as energy, minerals, and infrastructure require NDRC approval, while projects in other industries only require registration.

- Foreign exchange registration with the State Administration of Foreign ExchangeAfter ODI registration is approved, enterprises need to complete foreign exchange registration with the State Administration of Foreign Exchange. This step is to standardize the capital outflow process and ensure the legality and compliance of capital flows. Only after completing foreign exchange registration can enterprises legally remit funds overseas.

- Fund remittance and project implementationAfter completing foreign exchange registration, enterprises can remit funds through domestic banks for the establishment and operation of overseas investment projects. Additionally, enterprises need to regularly report investment progress to the competent authorities during project implementation, enabling the state to monitor investment situations in real-time.

4. Important Considerations for ODI Registration

- Strictly follow compliance procedures: Overseas investment involves many departments and procedures. Enterprises must ensure that materials and procedures at each step comply with regulations to avoid affecting investment progress.

- Ensure compliance of funding sources: ODI registration has strict requirements for investment funding sources. Enterprises need to prove the legality of funding sources, such as using their own funds or legal financing, ensuring funds are not involved in money laundering, tax evasion, or other illegal activities.

- Understand the target country's investment policies: Different countries have different policy requirements and restrictions on foreign investment. Enterprises should understand the laws and regulations of the target country before ODI registration to ensure project legality and feasibility.

- Conduct risk assessment and planning: Overseas investment often involves political, exchange rate, market, and other risks. Enterprises should conduct detailed risk assessments before registration and develop response strategies to ensure project stability.

- Seek professional advisory support: Since ODI registration involves complex legal, financial, tax, and foreign exchange management issues, it is recommended that enterprises seek assistance from professional overseas investment advisors to ensure smooth processes, compliance, and investment success rates.

5. Conclusion

ODI registration is a necessary step for Chinese enterprises to conduct overseas investment. Through registration, enterprises can legally and compliantly conduct business overseas, laying the foundation for globalization development. ODI registration is not only a compliance requirement but also provides policy support and legal protection for enterprises' overseas expansion. During the registration process, enterprises should strictly follow procedures, ensure compliance of funding sources, fully consider investment risks, and seek professional support. Through effective planning and implementation, ODI will become an important pathway for Chinese enterprises to enter international markets, helping them with global layout and business expansion.